The Project

Despite the technological advancements in the banking industry, most banking software applications have not undergone significant platform changes in over 30 years. Infor FSM (Financials & Supply Management) software offers comprehensive enterprise resource planning (ERP) functionality with industry-specific features, eliminating the need for extensive customizations.

The features and flexibility of this software project were carefully designed to deliver enterprise banking intelligence and a networked analytics platform that provides relevant, memorable experiences for both customers and bank employees. All this is delivered in a unified UI environment that enhances usability.

This solution combines the Infor cloud platform built on additional infrastructure services from Infor FSM, Amazon Web Services (AWS), and Infor OS (Operating Service). Its core technology provides networked analytics and a best-in-class user experience enhanced by artificial intelligence (AI).

Using Infor’s Banking prototype, organizations in the financial services, banking, insurance, and capital markets sectors will be able to assess risks, take proactive measures, and be more competitive than ever before.

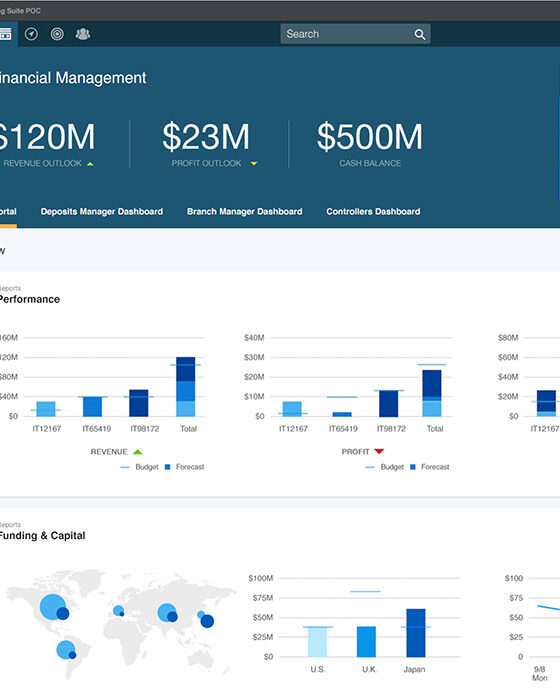

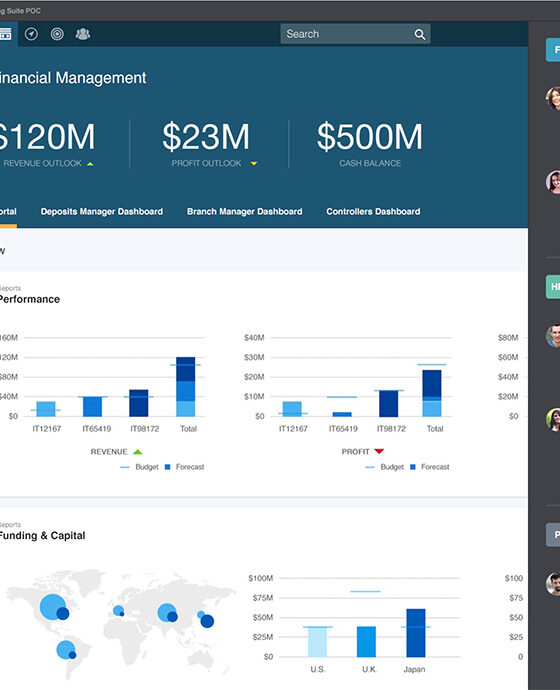

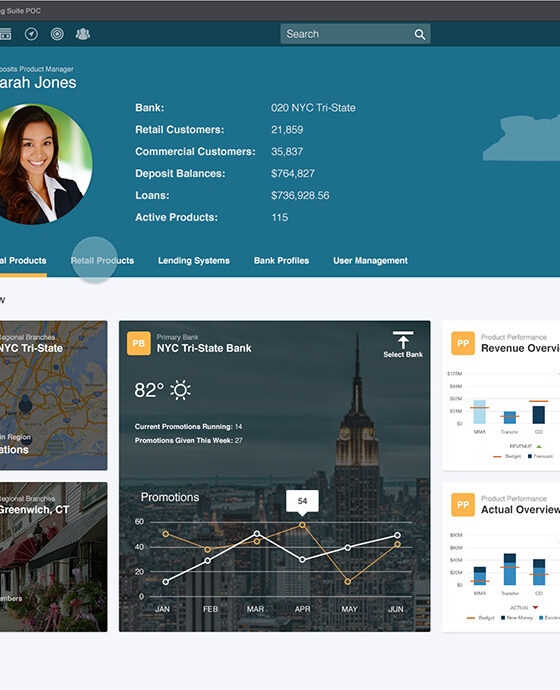

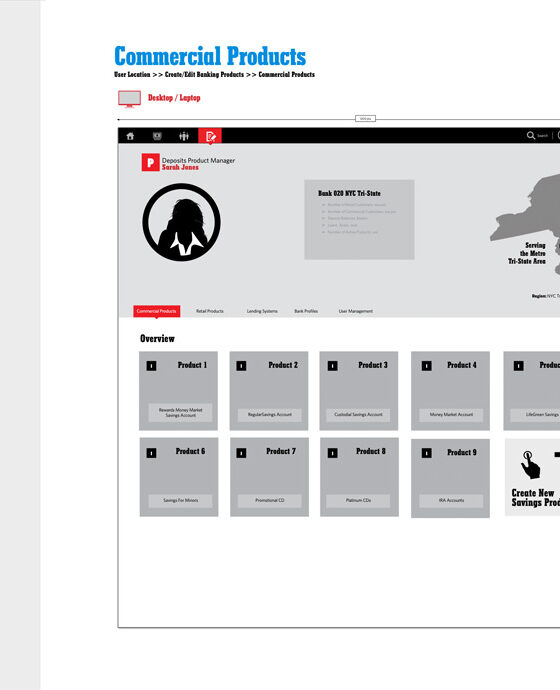

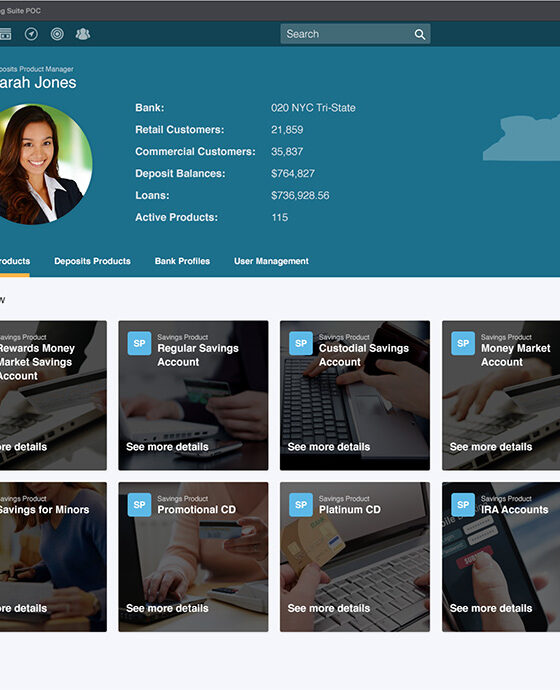

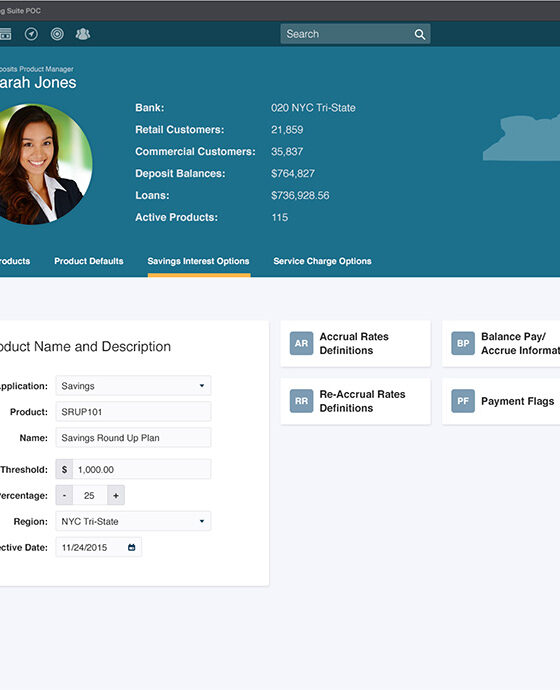

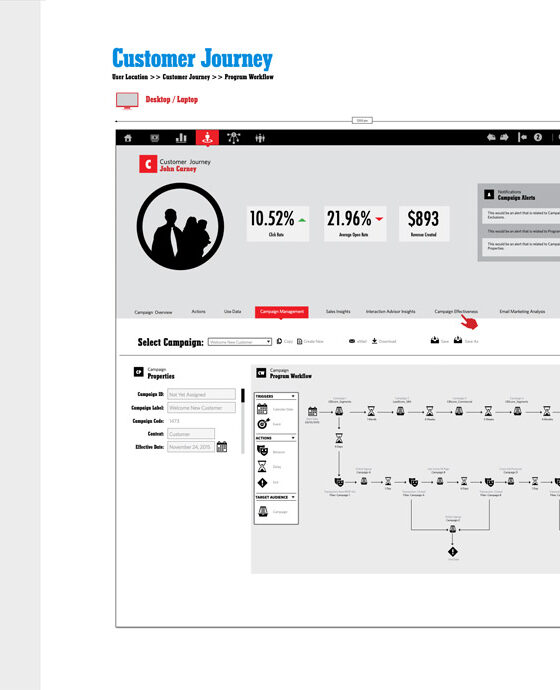

The User Experience

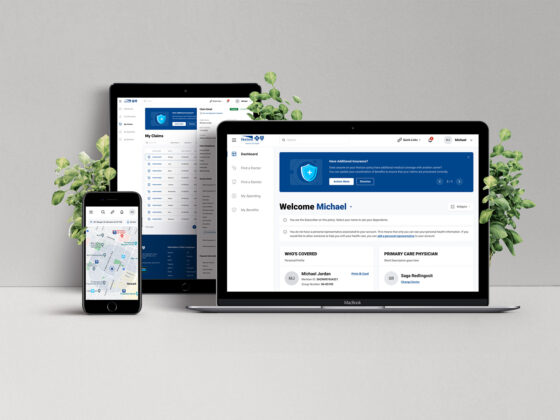

The user-centric UX prototype would leverage the capabilities of Infor FSM. This project was created as a ‘Proof of Concept’ to assist financial institutions in transforming their infrastructure. Our goal was to help large-scale financial institutions improve their customer experience, increase profitability, modernize their financial reporting systems, and optimize their workforce.

With Infor’s cloud-based solutions, integration into existing systems is simple. User experience is a priority for the system, which is based on data science. Teams and applications can be connected using the software prototype to make better decisions. Furthermore, it offers enterprise banking intelligence and a networked analytics platform.

• Analytics are embedded in context at the point of decision.

• AI-powered self-service features with personalized insights.

• Automated data refinement from any data source.

• Utilizes key service-line metrics to meet business objectives.

• Optimizes efficiency and margins while minimizing costs and risks.

• Using Infor’s Banking prototype, organizations in the financial services, banking, insurance, and capital markets sectors will be able to assess risks, take proactive measures, and be more competitive than ever before.

Key Features & Benefits

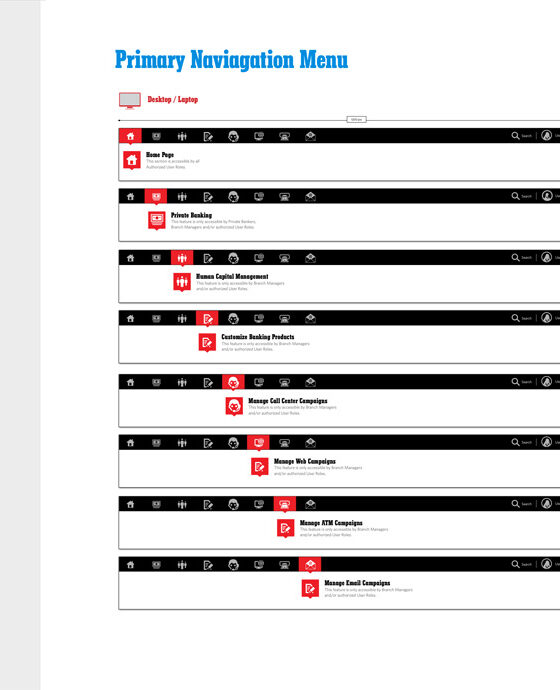

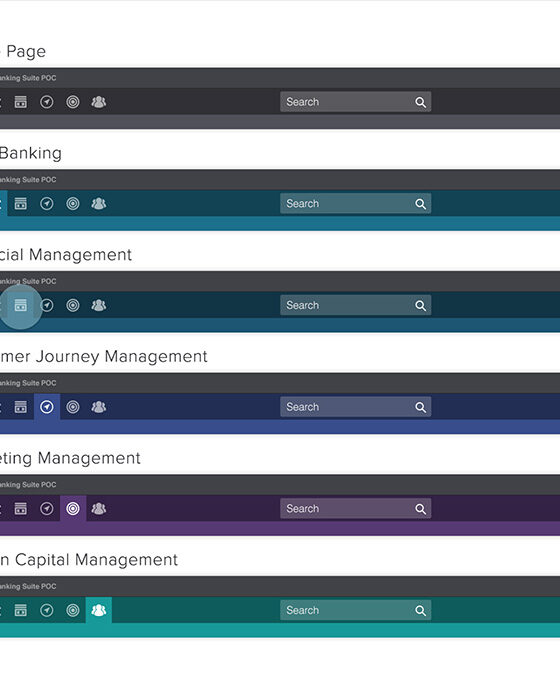

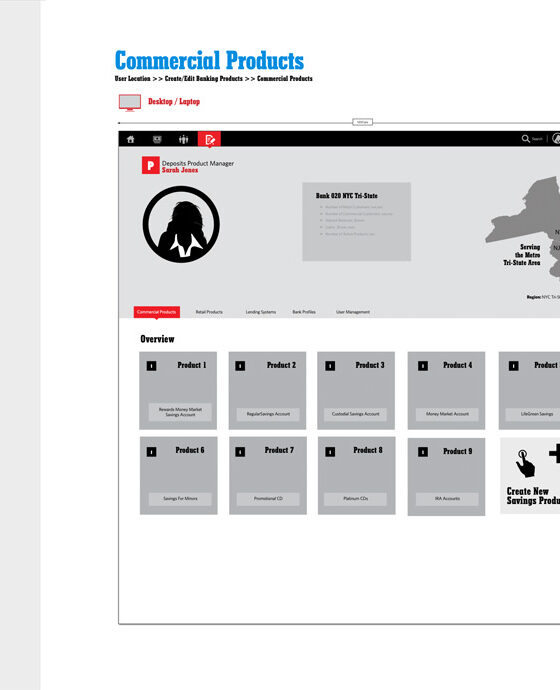

Unified User Interface

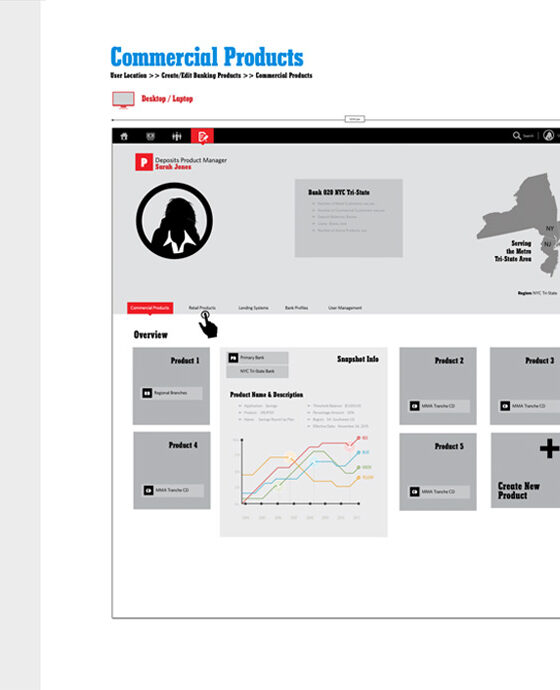

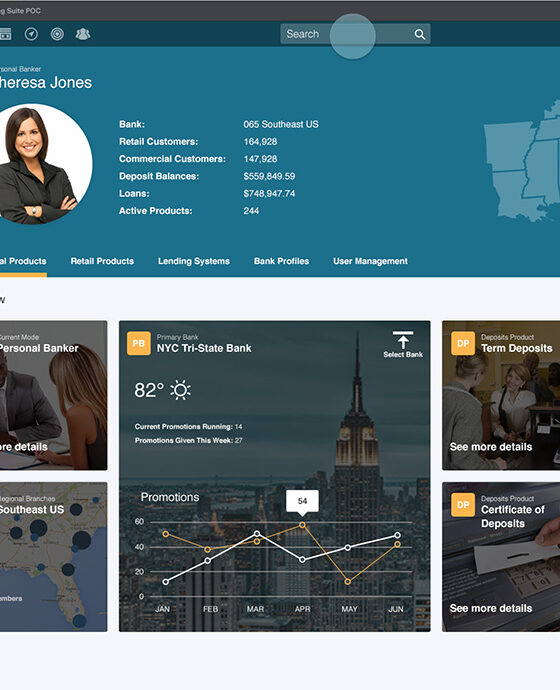

• Intuitive, role-based dashboards

• Consistent experience across devices (responsive design)

• Customizable widgets for personalized views

Enterprise Banking Intelligence

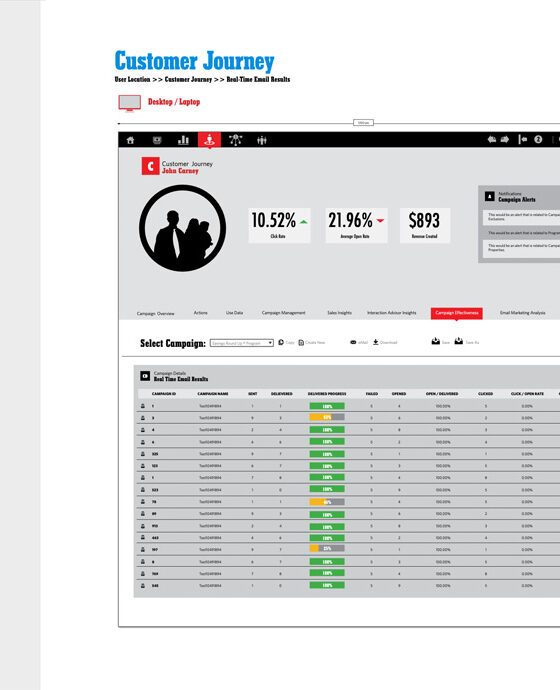

• Real-time data aggregation from multiple sources

• Predictive analytics for risk assessment and market trends

• Comprehensive reporting tools with customizable templates

Networked Analytics Platform

• Inter-departmental data sharing and collaboration tools

• Centralized data lake for holistic institutional insights

• API-driven architecture for easy integration with third-party tools

AI-Powered Capabilities

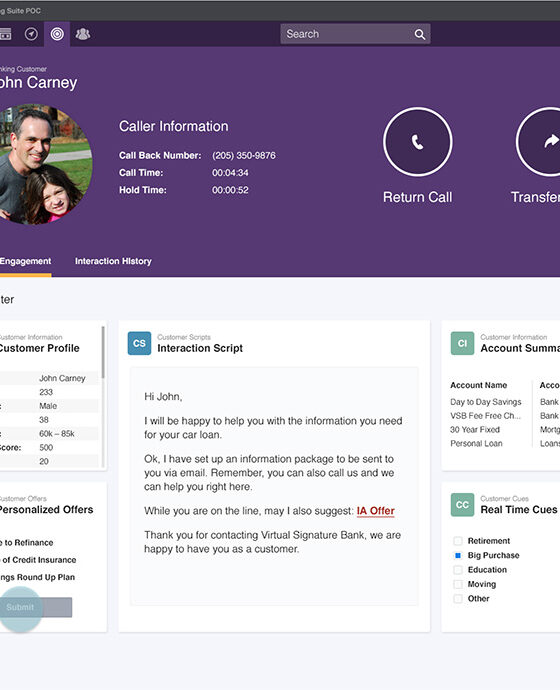

• Natural Language Processing (NLP) for customer service chatbots

• Machine Learning algorithms for fraud detection and prevention

• Automated loan underwriting and credit scoring

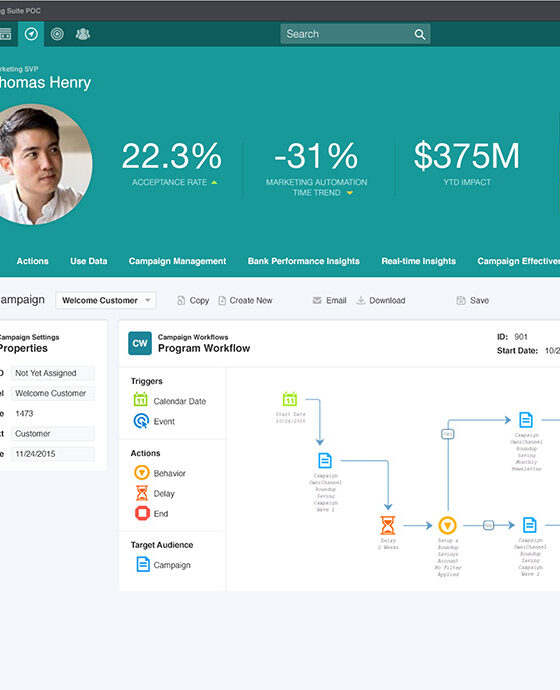

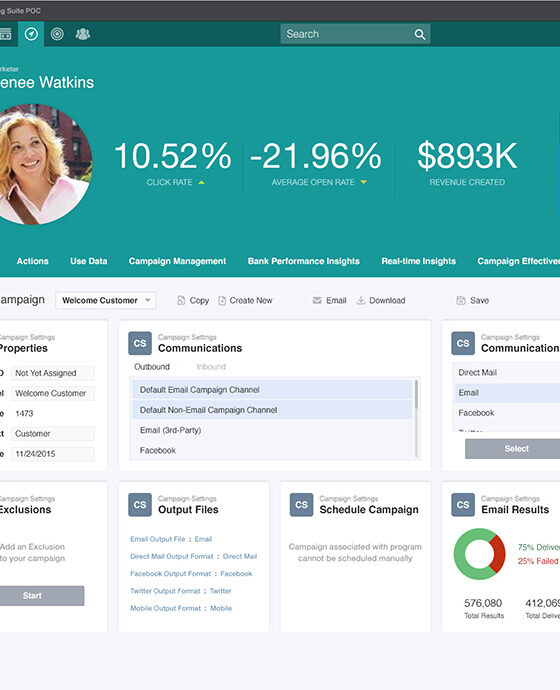

Customer Relationship Management (CRM)

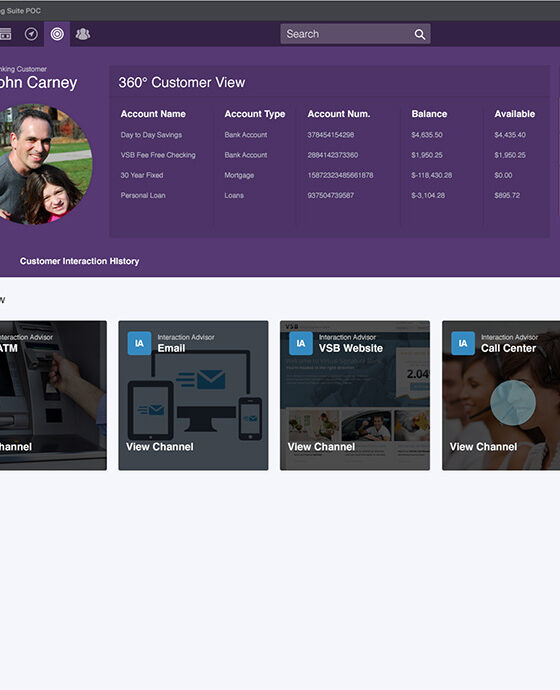

• 360-degree customer view with interaction history

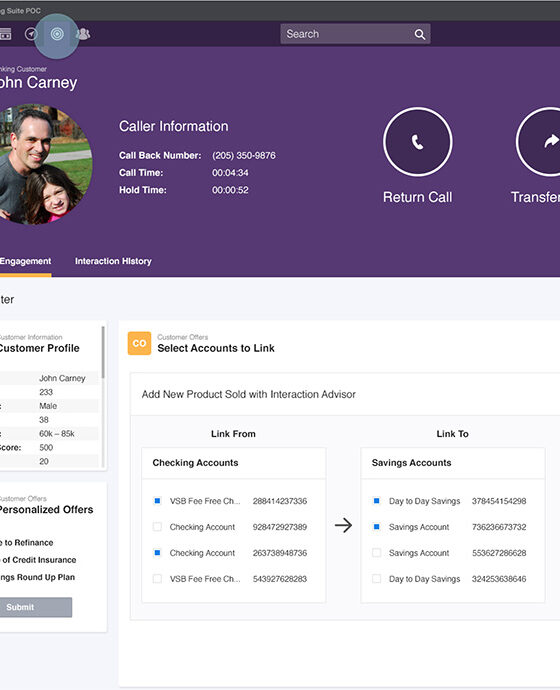

• Personalized product recommendations

• Automated marketing campaign management

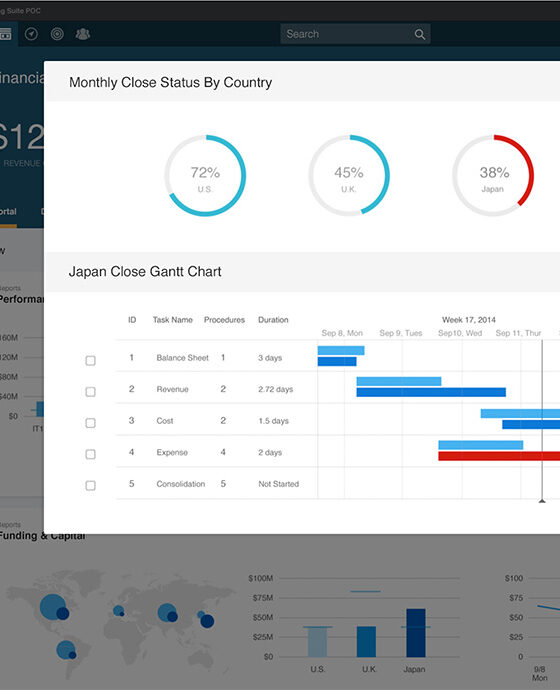

Regulatory Compliance and Reporting

• Built-in compliance checks for major financial regulations (e.g., Basel III, GDPR)

• Automated generation of regulatory reports

• Real-time monitoring of key risk indicators

Self-Service Portal

• Customer-facing online and mobile banking interfaces

• AI-driven personal financial management tools

• Secure document upload and storage

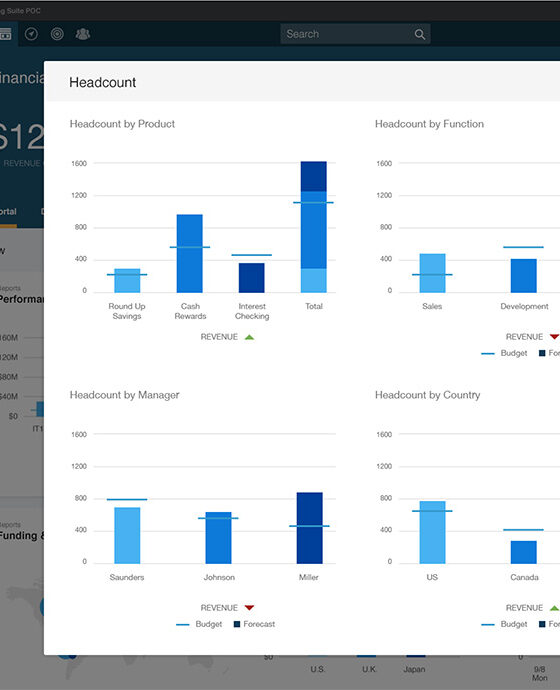

Operational Efficiency Tools

• Workflow automation for common banking processes

• Resource allocation optimization

• Performance analytics for employee productivity

Security and Risk Management

• Multi-factor authentication and biometric security options

• Real-time transaction monitoring for suspicious activities

• Encrypted data storage and transmission

Open Banking Readiness

• APIs for third-party integrations

• Sandbox environment for fintech partnerships

• Compliance with Open Banking standards

Additional Platform Tools

Personalized Dashboards

Both customers and employees benefit from tailored interfaces that prioritize the most relevant information and actions.

Contextual Analytics

Data insights are presented within the context of specific tasks or decisions, enabling more informed choices at every level.

AI-Assisted Interactions

From customer inquiries to complex financial analysis, AI augments human capabilities to enhance efficiency and accuracy.

Seamless Omnichannel Experience

Customers can start a transaction on one device and seamlessly continue on another, with real-time synchronization.

Proactive Alerts & Insights

The system anticipates user needs and provides timely notifications and recommendations.

Collaborative Tools

Internal teams can easily share data, analyses, and reports, fostering a more cohesive organizational approach.

Continuous Learning

The platform adapts to user behavior over time, continuously refining its recommendations and interfaces.

Operational Efficiency

Automation of routine tasks and AI-assisted decision-making streamline operations, reducing costs and minimizing human error.

Actionable Business Insights

Provides accurate, data-driven decisions by integrating with enterprise business intelligence (BI) and analytics platforms.

Operational Inefficiencies

There is an interconnection between financial, workplace, and operational processes, but they are processed in separate platforms.

Customer Loyalty

The new expectations of customers challenge traditional methods of customer engagement, brand excellence, and loyalty.

Security and Compliance

Security breaches and associated compliance concerns put enormous pressure on legacy technology solutions and IT departments.

Talent Management

Training, managing, and identifying the workforce is a challenging process that often depends on the discretion of the manager or branch.

We Build The Future.

Ready To Transform Your Digital Presence?

Please get in touch with us today and let’s talk about how we can work together to bring your vision to life.